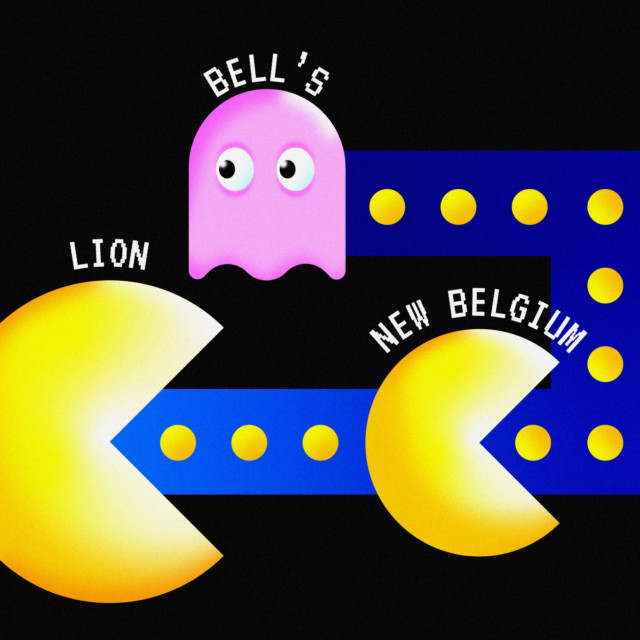

Last Wednesday, the beer industry learned of its latest craft brewery acquisition when Bell’s Brewery announced it will sell to Lion, an Australian subsidiary of Japan-based Kirin. Under Lion, Bell’s will join New Belgium, a fellow craft beer pioneer that sold to Lion/Kirin in 2019.

Bell’s is widely known as a pioneer of Michigan craft beer. The producer of such beloved brands as Two Hearted Ale and Oberon Wheat Ale will be 100 percent owned by Lion once the sale is complete within the coming months. Through the sale, Bell’s will lose its craft brewer status per the Brewers Association. In an announcement to employees and letter published on the brewery website, founder and CEO Larry Bell simultaneously shared that he will be retiring from the company. Carrie K. Yunker will continue to lead the brand as Bell’s executive vice president, a role appointed in January.

According to a press release, Bell said: “This decision ultimately came down to two determining factors. First, the folks at New Belgium share our ironclad commitment to the craft of brewing and the community-first way we’ve built our business. Second, this was the right time. I’ve been doing this for more than 36 years and recently battled some serious health issues. I want everyone who loves this company like I do to know we have found a partner that truly values our incredible beer, our culture, and the importance of our roots here in Michigan.”

If I said I wasn’t feeling some type of way about the sale, I’d be lying. Any craft beer lover who hears “Bell’s” and doesn’t get the warm and fuzzies clearly hasn’t been around long enough to remember Oberon summers, or smuggling 6-packs of Two Hearted into house parties to share with a select few who “knew” or were curious.

Bell’s became a top-10 brewery on its own merits. It is — was — one of the few surviving companies on that list that remains family owned, leaving only Sierra Nevada in its wake.

The press release repeatedly refers to the “combination of Bell’s and New Belgium,” “Bell’s decision to join New Belgium,” and “aligning with New Belgium” — and that by doing so, “Bell’s will expand on its own commitments to coworkers, communities, and customers by adopting many hallmark, human-powered business practices.”

In an earlier version of this article, I wrote: “This is not only misleading, but inaccurate. Bell’s is not merging with New Belgium. It’s not selling to New Belgium, either. Each brewery sold (separately, two years apart) to an Australian arm of a Japanese beer corporation.”

However, I stand corrected: A New Belgium spokesperson disclosed in an email that “a significant chunk of the purchase price is coming directly from New Belgium,” and that “after the sale closes, Bell’s will be fully integrating into New Belgium, with New Belgium CEO Steve Fechheimer and an expanded leadership team (the current New Belgium leadership team plus the addition of Carrie Yunker and John Mallett from Bell’s) leading the combined operation. While it’s true that Lion was involved in the acquisition, New Belgium and Bell’s will become one enterprise after the deal is closed.”

In short, “Bell’s will legally become part of New Belgium’s U.S. operations.”

Still, a deal is a deal. What I wonder is not why Bell’s decided to sell; but rather, why it tried to hide the elephant (er, lion) in the room by shrouding it in misleading we’re-still-independent-craft language.

The reasons for the sale are simple. Larry Bell himself told Brewbound, “I’ve been CEO of Bell’s for over 38 years. I founded it in 1983 at age 25. That’s a long time to be CEO.”

That is a long time to be CEO. By Bell’s calculation, he founded this company close to 40 years ago. As an observer of and participant in this industry for less than a third of that time, I’ve seen many of the top craft breweries struggle to navigate, or even stay afloat, in the sea change craft brewing has seen even in the last decade.

At VinePair and across the beer industry, we’ve been discussing for years various predictions of what will become of regional and national craft brands like Bell’s — those that once looked into a future of perpetual growth that slowly blurred into perpetual purgatory “between a rock and a hard place.” We watched as major craft players from the same era sold to what was once a sworn enemy, Anheuser-Busch InBev (AB InBev): Goose Island the famous first in 2011; Blue Point and 10 Barrel in 2014; Elysian, Golden Road, and Breckenridge in 2015; and more to follow. We saw Constellation buy Ballast Point for $1 billion in 2015. And we rooted for Canarchy’s private equity model under Fireman Capital, also established in 2015.

So, what will become of the craft beer pioneers? The answer is turning out to be as simple as selling before collapse, and I can’t criticize that.

New Five Drinks CEO Will Lead Canned Cocktail Brand Into RTD Glory

Last week, Five Drinks appointed Michael Taylor as its new president and CEO, meaning he’s joined the ranks of Five Drinks leadership: former Anheuser-Busch InBev High End president Felipe Szpigel; 10 Barrel Brewing co-founders Jeremy and Chris Cox; and former ZX Ventures executive Roberto Schuback.

Taylor, most recently CEO of Green Flash Brewing, is also an AB InBev expat who worked with Szpigel for 14 years there, according to Brewbound.

As Five Drinks CEO, Taylor will oversee the canned cocktail company’s expansion into several states, as it debuts new flavors and a limited run of 12-ounce can offerings.

Five Drinks may call itself a “startup,” and while that may be technically correct, it’s the most stacked startup RTD brand I’ve come in contact with. It’s a dream team of ex-AB InBev executives and affiliates who, no doubt, know exactly how to maximize recipe development and market presence, and maintain quality control. If high-quality canned cocktails are what American shoppers are looking for, I have no doubt Five Drinks will succeed in reaching them. If it turns out we all want hard seltzer, I have no doubt this leadership will find a way to pivot.

Miller Lite Partners With Best-Selling Author on ‘Beers and Queer History’ Book

Recently, a light-beer–loving friend slipped an Instagram post from Miller Lite into my DMs.

Announced last month, “Beers & Queer History,” authored by Dr. Eric Cervini, is a 25-page book chronicling 10 pivotal moments in LGBTQ+ history, all of which took place in bars — “with queer bars at the center of them all,” Cervini wrote in a paid Instagram post announcing the project. According to Miller Lite, 100 percent of proceeds will benefit Equality Federation, an advocacy accelerator that works with state-level LGBTQ+ supporters. The book is part of Miller Lite’s “Open & Proud” program, a multi-year partnership with the Equality Federation. The book is scheduled for release in 2022 and is available for pre-order in Miller Lite’s online shop.

“As you know, queer bars have been the settings for some of the most important moments of our community’s past. Riots, uprisings, rebellions, protests, political campaigns — all made possible because of queer bars. Contained in their walls are reminders of how far we’ve come, and when they fail us, symbols of how far we have yet to go.” —@ericcervini

While I always view LGBTQ+ advocacy with a critical eye — especially when Big Beer is involved (recall the Bud Light rainbow bottle) — I see this as a smart move for Miller Lite. It’s smart for Cervini, too: Who wouldn’t want to flex their historical expertise to raise money for a charitable organization — with one of the country’s biggest beer brands to back it?

Admittedly, I’m unaware of whether or how much this effort aligns with Miller Lite’s company culture. I genuinely question, too, whether or how much this will resonate with the average Miller Lite drinker. But if it at least grabs the attention of a few more Instagram users — those who perhaps haven’t considered the book’s subject — I can count those as small successes, with expectations for Miller Lite and other beer brands to continue partnerships like these in the future.

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!